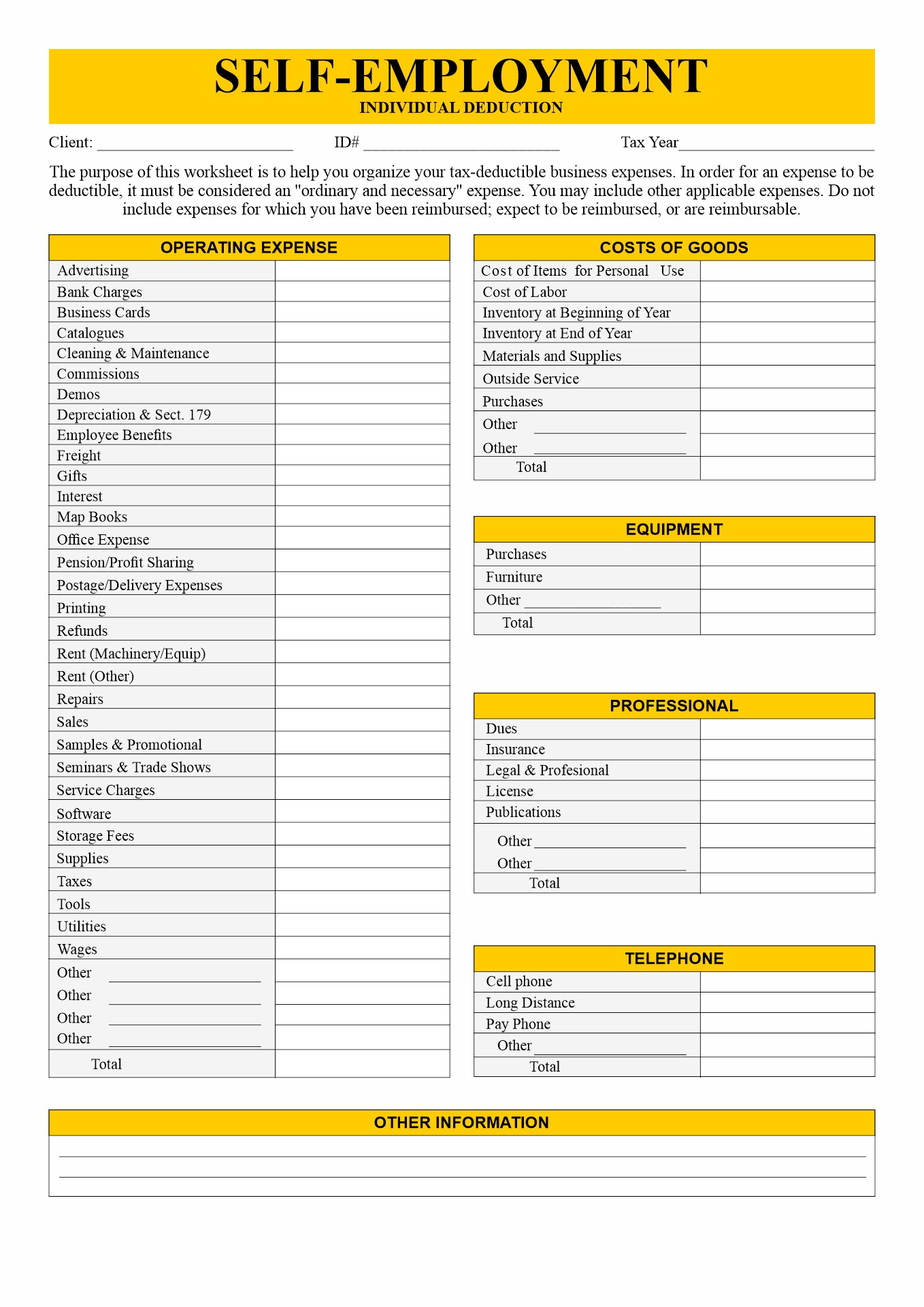

2025 Self Employment Tax And Deduction Worksheet. Ideal for contractors or content creators, it. For 2025, the rate is 67 cents per mile.

This limit is $345,000 in 2025, $330,000 in 2025, $305,000 in 2025, $290,000 in 2025, $285,000 in 2025 and $280,000 in 2019 and is adjusted annually. Using a tax prep checklist can help you prepare for the 2025 tax season and reduce stress.

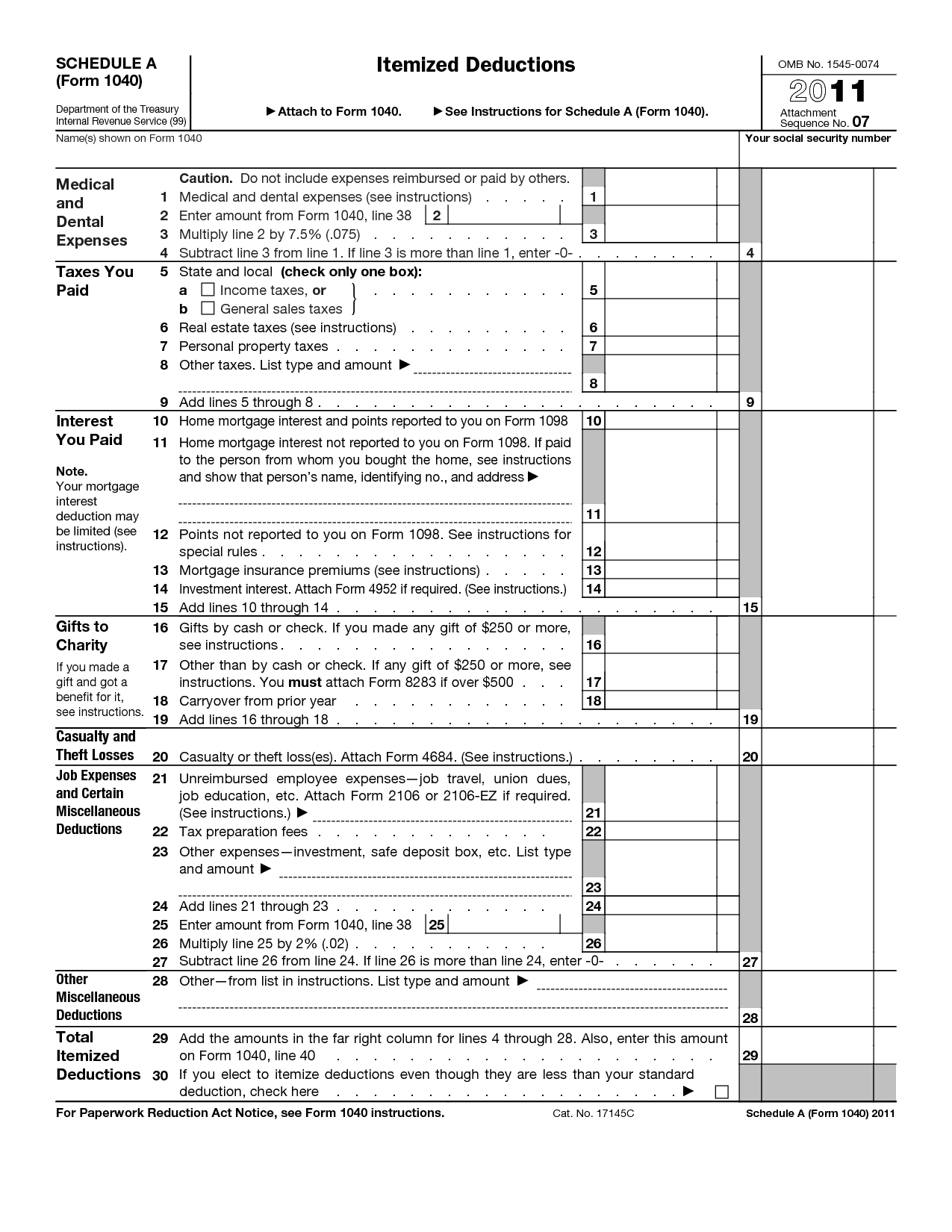

Now, employees who want to lower their tax withholding must claim dependents or use a deductions worksheet [0] internal revenue service.

For 2025, the first $168,600 of earnings is subject to the social security portion (up from $160,200 in 2025).

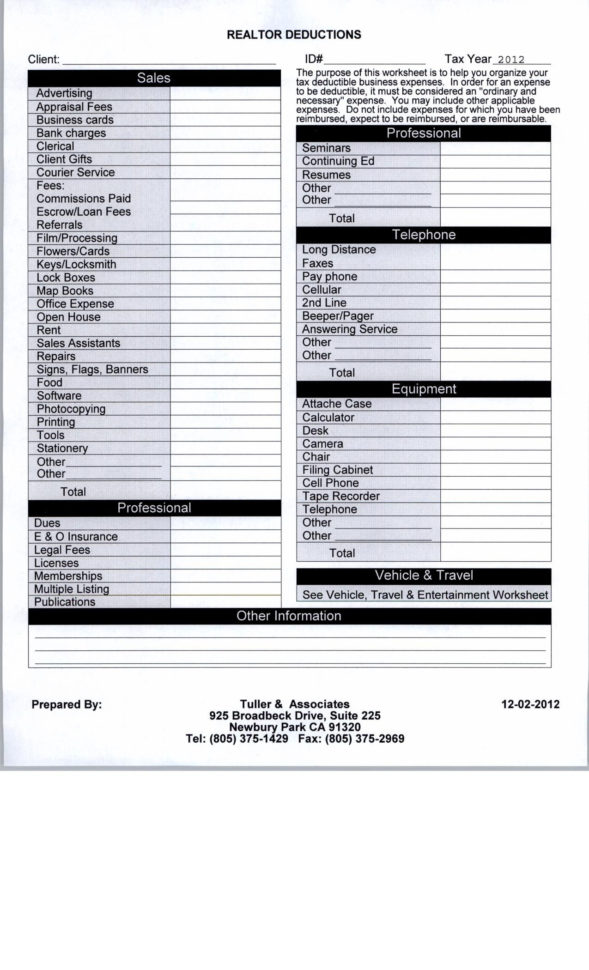

Self Employment Tax Guide for Online Sellers — Tax Hack Accounting Group, If you’re a sole proprietor, you file taxes. For 2025, the first $168,600 of earnings is subject to the social security portion (up from $160,200 in 2025).

Self Employed Tax Deductions Worksheet Worksheet Resume Examples, This includes freelancers , independent contractors , and small business owners. What is self employment tax rate for 2025 & 2025?

20 Self Motivation Worksheet Free PDF at, The way the reimbursement works is that you multiply your total annual business mileage by the standard rate. This limit is $345,000 in 2025, $330,000 in 2025, $305,000 in 2025, $290,000 in 2025, $285,000 in 2025 and $280,000 in 2019 and is adjusted annually.

2016 Self Employment Tax And Deduction Worksheet —, For 2025, the first $168,600 of earnings is subject to the social security portion (up from $160,200 in 2025). The deduction comes with its fair share of rules, and the income.

Self Employed Worksheet, What is self employment tax rate for 2025 & 2025? Qualified business income (qbi) deduction;

IRS Form 1040 Standard Deduction Worksheet 1040 Form Printable, Now, employees who want to lower their tax withholding must claim dependents or use a deductions worksheet [0] internal revenue service. Ideal for contractors or content creators, it.

2025 Self Employment Tax and Deduction Worksheet, This includes freelancers , independent contractors , and small business owners. Ordinary and necessary business expenses;

Deductions Worksheets Calculator, The deduction comes with its fair share of rules, and the income. Here’s a roundup of essential documents you’ll need.

Printable Itemized Deductions Worksheet, The 15.3% may shock those who are newly self. Qualified business income (qbi) deduction;

Alabama Federal Tax Deduction Worksheet, For 2025, the first $168,600 of earnings is subject to the social security portion (up from $160,200 in 2025). Using a tax prep checklist can help you prepare for the 2025 tax season and reduce stress.